The Vienna Institute of International Economic Studies (wiiw) has just published a new policy note proposing a financing model for a European Silk Road. A large part of the European transport infrastructure is in poor condition, even in some affluent parts of Europe, such as Germany. The periphery of Europe has considerable economic catching up to do – partly because of massive infrastructure deficits.

The proposed “European Silk Road” project should help to solve both the problem of sluggish growth in the west of the continent and the development problems in the east. It could also be a new narrative about cooperation in Europe.

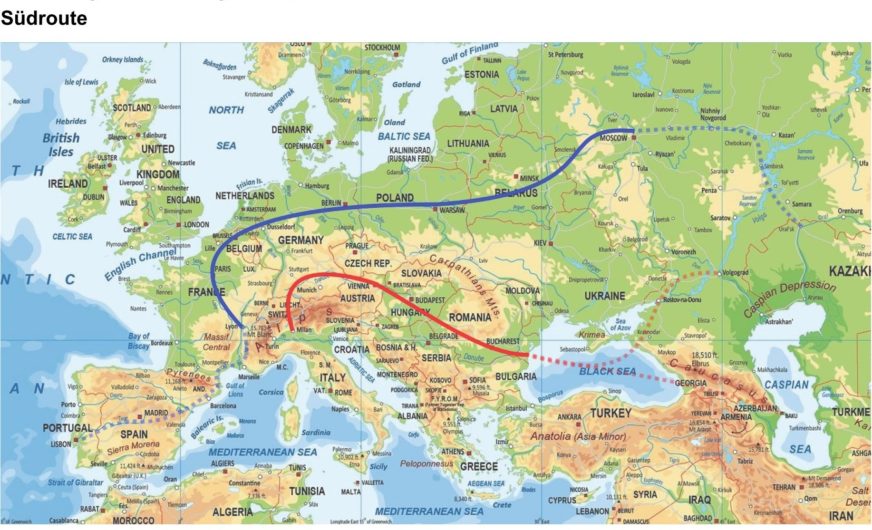

The new transport infrastructure (a combination of e-mobility highways, high-speed railways, ports and logistics centres) would connect the industrial areas of the west with the densely populated but less developed regions in the east of the continent.

The wiiw makes a proposal for financing infrastructure investments on the European continent through a European Silk Road Trust (ESRT) supported by a European Sovereign Wealth Fund (ESWF). In the initial phase, the European Central Bank could reinvest part of its assets in a way that entails more risk, but also more revenue, according to the structure of the Norwegian oil fund.

It is expected that the ESWF will grow to around 3 percent of the euro area’s GDP in the longer term. This should be sufficient to guarantee the ESRT bonds – even if long-term interest rates move back to positive in the distant future.

The estimated construction costs of 1 trillion euros (7% of EU GDP) should bring substantial economic gains along the route (11,000 kilometres over land) in the short, medium and long term. In addition to the growth and employment effects of construction activity (2-7 million new jobs during the construction phase), considerable trade effects are also expected.