In a context of geopolitical uncertainty, the CMA CGM Group continues to focus its efforts on operational efficiency, cost control and the rationalization of its industrial activities and brands. In addition, the positive momentum generated by the acquisition of Ceva Logistics will gradually enable the Group to benefit from a less volatile and more diversified environment than the maritime sector.

Thanks to all the measures put in place, the Group is confident for the second half of 2019, which should be better than the first one. The CMA CGM Group will continue to improve its financial performance and adapt its commercial offering in order to provide its customers end-to-end offers.

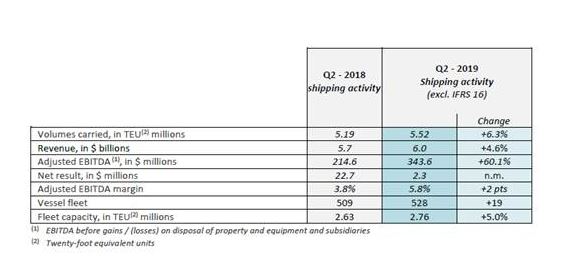

The Group’s shipping business remained strong in the second quarter of 2019, with significant improvement in volumes carried and in profitability, enabling the shipping activity to post a positive net result. Volumes transported by CMA CGM increased by 6.3% compared to the second quarter of 2018 and by 6.8% compared to the first quarter of 2019.

This positive trend, which is above market, is driven by the strong growth of intra-regional lines (short sea) and the United States lines, which remain particularly dynamic. The Group thus relies on the network of intra-regional companies’ expertise that are leaders in their sectors:

– CNC, a specialist in Intra-Asia,

– Mercosul, a leader in cabotage and door-to-door services in Brazil.

– ANL, an expert for Australia and Oceania,

– Containerships, specialist in intra-Europe.

Second quarter revenue was up 4.6% compared to the second quarter of 2018 and reached USD 6 billion for the Group’s shipping activities. The deployment of the cost reduction plan allowed to reduce operational expenses by USD 51 per TEU in the second quarter compared to the first quarter of 2019. This mainly comes from initiatives to rationalize certain trades, the efforts to always improve operational efficiency, lower logistics costs and the reduction of the Group’s ships consumption.

Adjusted EBITDA came to USD 343.6 million and the EBIT margin amounted to 5.8%. The net result of the shipping operations reaches USD 2.3 million.