In Q2 2018, transport prices have soared in the European transport market due to declining capacity and rising fuel prices, reveals the thirty-sixth edition of the Transport Market Monitor by Capgemini Consulting and Transporeon.

Highlights of the report:

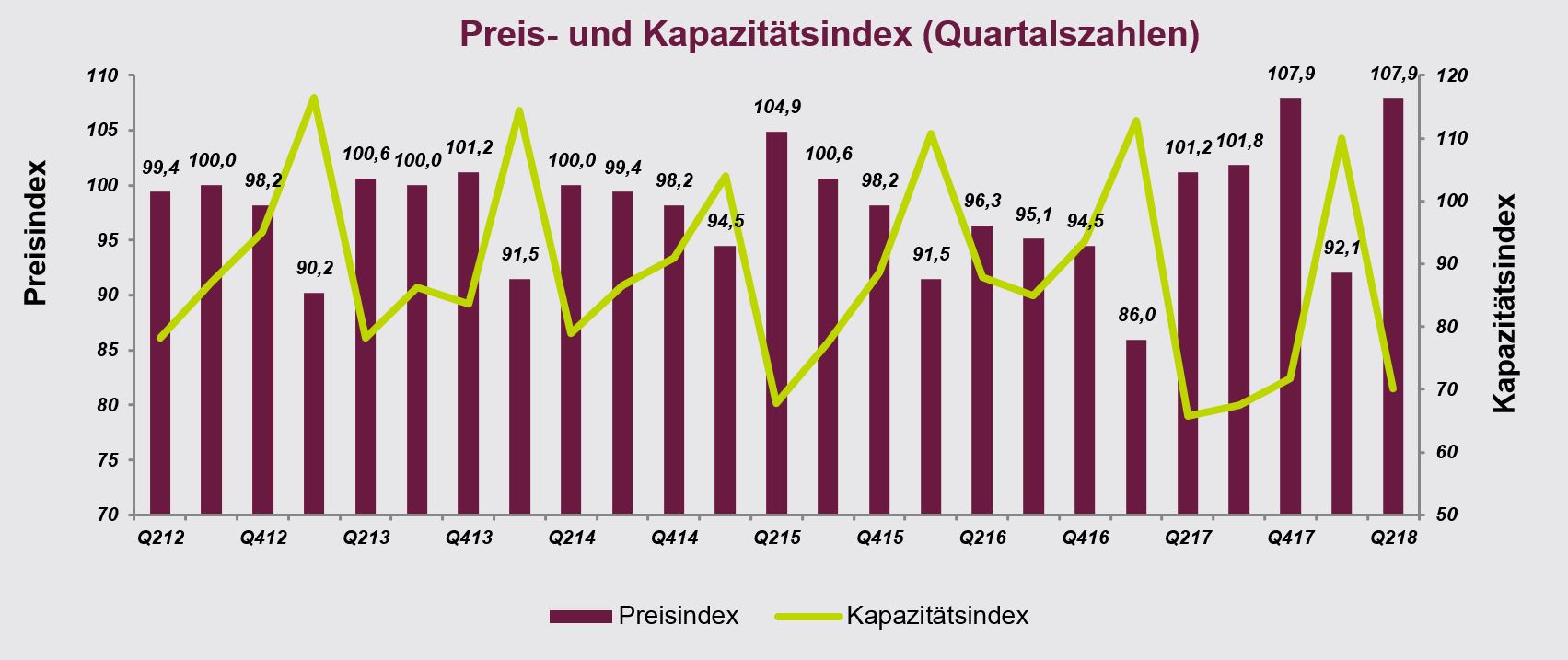

- In Q2 2018, the capacity index decreased by 36.3 per cent to 70.1 compared to the previous quarter (index 110.1). In Q2 2017 the capacity index was 65.8, which means the index value for Q2 2018 is 6.6 per cent higher than in 2017.

- The price index increased in Q2 2018 to an index of 107.9, which is an increase 17.2 per cent compared to Q1 2018 (index 92.1). Compared to the price index of Q2 2017, the price index increased by 6.6 per cent.

- The diesel index showed an increase of 9.3 per cent compared to Q1 2018.

- In Q2 2018 trade volumes in Europe are expected to decrease by 11.6 per cent to EUR 2,060 billion compared to Q1 2018 ( EUR 2,330 billion).

Ralph Schneider-Maul, Supply Chain Manager at Capgemini Consulting in Germany, Austria and Switzerland says: “Our prediction on transportation costs became a reality. In the second quarter transportation costs reached the record of Q4, 2017. But what is even more important, transportation costs might rise to a new record high in the second half of this year. This is a direct result of continuously rising fuel and driver costs while at the same time transport demand increases across all industries.”

In his opinion, it will be interesting to see if there will be any impact on transport capacity now the European Union has relaxed cabotage regulation. Furthermore, it is yet unclear of the predicted consumer demand will actually become reality, and the economic development will cool down – as prognosticated by some institutions. This would definitely trigger a change in the transport market.

Oliver Kahrs, Director, Business Development at Transporeon, adds: “The available transport capacity fluctuates around a historically low level, which pushes transport prices upwards. A current survey by Transporeon shows that the driver shortage and shortages in free load space are the greatest challenges for freight forwarders in 2018. In this context, two thirds of the transport service providers see the expansion of digital processes as an opportunity to win customers for connected loads and reduce empty kilometers. Indeed, a large part of the missing capacities could be gained by a more efficient networking of the shippers and a higher load factor of the trucks in use.”